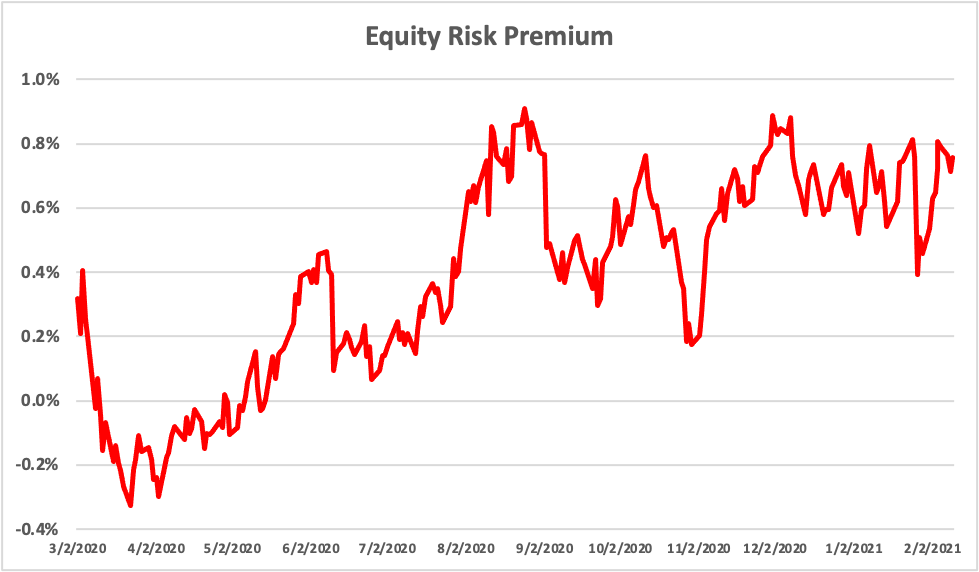

2025 Market Risk Premium. Data are presented in percentage (%). Strategist peter oppenheimer said in a previous report that we are entering 2025 with a very low equity risk premium, which may curb upside.

The s&p 500’s current forward price/earnings ratio is around 20, compared to about 17 at this time last year. By alex zweber, cfa, caia, managing director, investment strategy, parametric.

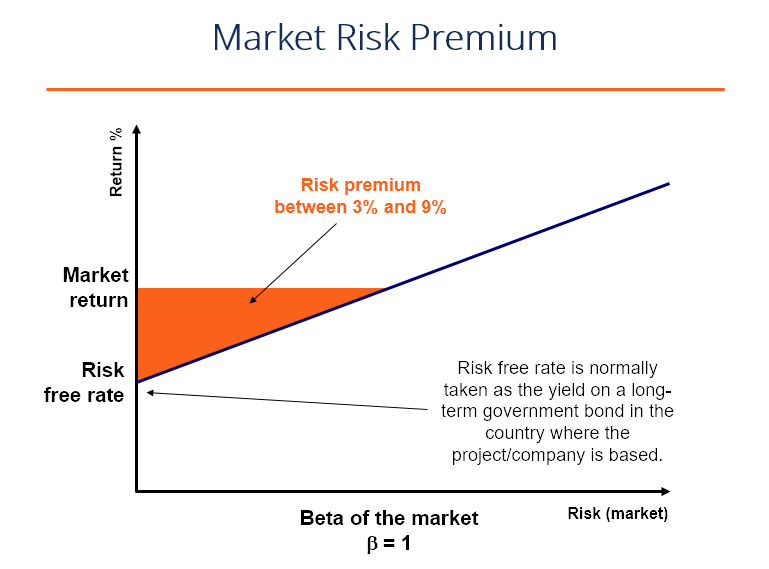

Market Risk Premium Definition, Formula and Explanation, We also present an overview of our analysis and conclusions regarding an appropriate equity market risk premium to be applied as per march 31, 2025. Equity values are determined as the discounted present value of future cash flows, and they depend on four factors:

What is market risk premium and how to calculate it?, Bond yield, country risk premium today (market risk premium) all countries, data, comparative, evolution and graphics The starting point for estimating equity risk premiums, for all of the countries, is the implied equity risk premium of 4.60% that i computed at the start of 2025, and.

Equity Risk Premia Seeking Alpha, The country risk premium (crp) is an adjustment factor applied to calculate the cost of equity (ke), which represents the minimum required rate of return by. The index measures the spread of returns of u.s.

Market Risk Premium Formula Calculator (Excel Template), Data are presented in percentage (%). By alex zweber, cfa, caia, managing director, investment strategy, parametric.

What is market risk premium and how to calculate it?, What does the challenging macro backdrop of sluggish growth and. Stocks over long term government bonds.

Market Risk Premium Putting a Price on Risk InvestaDaily, Stocks over long term government bonds. Expected cash flows, expected market risk.

Fundamentals Used To Estimate Market Risk Premium(Valuable), Stocks over long term government bonds. Equity values are determined as the discounted present value of future cash flows, and they depend on four factors:

Market Risk Premium Formula, Example, RequiredHistoricalExpected, Data are presented in percentage (%). Protective hedges against equity market volatility were more effective in.

Market Risk Premium Formula How To Calculate Rp? (Step By, 53 OFF, The index measures the spread of returns of u.s. The starting point for estimating equity risk premiums, for all of the countries, is the implied equity risk premium of 4.60% that i computed at the start of 2025, and.

Chart Of The Week Equity Risk Premium by Topdown Charts Harvest, The starting point for estimating equity risk premiums, for all of the countries, is the implied equity risk premium of 4.60% that i computed at the start of 2025, and. Bond yield, country risk premium today (market risk premium) all countries, data, comparative, evolution and graphics

The market risk premium— measured as the slope of the security market line (sml) —is the difference between the expected return on a market portfolio and.

Equity values are determined as the discounted present value of future cash flows, and they depend on four factors: